Many people think they understand why domestic prices rise with tariffs–domestic producers take advantage of reduced competition to jack up prices and increase their profits. The explanation seems cynical and sophisticated and its not entirely wrong but it misses deeper truths. Moreover, this “explanation” makes people think that an appropriate response to domestic firms raising prices is price controls and threats, which would make things worse. In fact, tariffs will increase domestic prices even in perfectly competitive industries. Let’s see why.

Suppose we tax imports of French and Italian wine. As a result, demand for California wine rises, and producers in Napa and Sonoma expand production to meet it. Here’s the key point: Expanding production without increasing costs is difficult, especially so for any big expansion in normal times.

To produce more, wine producers in Napa and Sonoma need more land. But the most productive, cost-effective land is already in use. Expansion forces producers onto less suitable land—land that’s either less productive for wine or more valuable for other purposes. Wine production competes with the production of olive oil, dairy and artisanal cheeses, heirloom vegetables, livestock, housing, tourism, and even geothermal energy (in Sonoma). Thus, as wine production expands, costs increases because opportunity costs increase. As wine production expands the price we pay is less production of other goods and services.

Thus, the fundamental reason domestic prices rise with tariffs is that expanding production must displace other high-value uses. The higher money cost reflects the opportunity cost—the value of the goods society forgoes, like olive oil and cheese, to produce more wine.

And the fundamental reason why trade is beneficial is that foreign producers are willing to send us wine in exchange for fewer resources than we would need to produce the wine ourselves. Put differently, we have two options: produce more wine domestically by diverting resources from olive oil and cheese, or produce more olive oil and cheese and trade some of it for foreign wine. The latter makes us wealthier when foreign producers have lower costs.

Tariffs reverse this logic. By pushing wine production back home, they force us to use more costly resources—to sacrifice more olive oil and cheese than necessary—to get the same wine. The result is a net loss of wealth.

Note that tariffs do not increase domestic production, they shift domestic production from one industry to another.

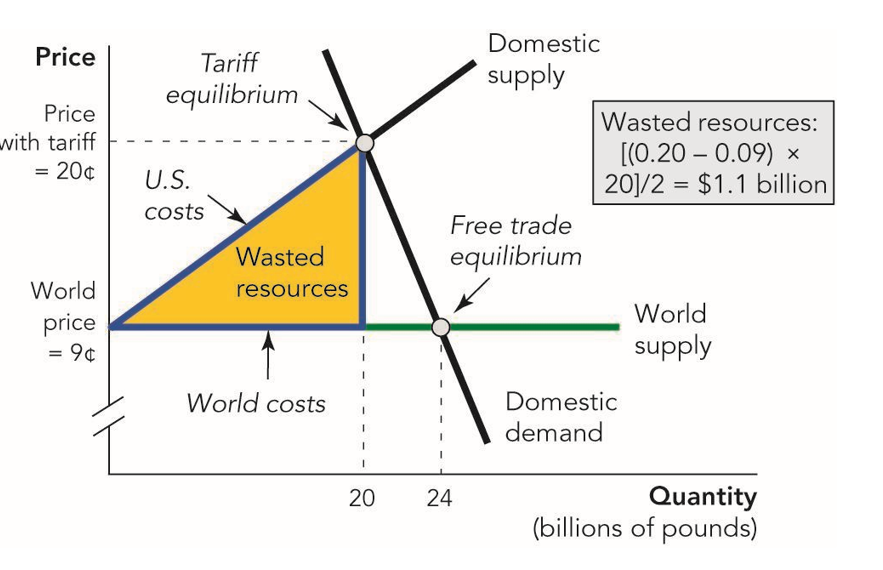

Here’s the diagram, taken from Modern Principles, using sugar as the example. Without the tariff, we could buy sugar at the world price of 9 cents per pound. The tariff pushes domestic production up to 20 billion pounds.

As the domestic sugar industry expands it pulls in resources from other industries. The value of those resources exceeds what we would have paid foreign producers. That excess cost is represented by the yellow area labeled wasted resources—the value of goods and services we gave up by redirecting resources to domestic sugar production instead of using them to produce other goods and services where we have a comparative advantage.

All of this, of course, is explained in Modern Principles, the best textbook for principles of economics. Needed now more than ever.

The post Why Do Domestic Prices Rise With Tarriffs? appeared first on Marginal REVOLUTION.