Dogecoin is now at a crucial demand level after a 4% rise from local lows, stirring serious speculation in the market. The meme coin has caught the attention of analysts and traders, with mixed opinions about its next move. Some believe Dogecoin is preparing for a rally, while others suggest further declines could be ahead.

Key data from IntoTheBlock highlights the importance of short-term traders in driving liquidity for meme coins like DOGE. This cohort of traders remains a significant source of activity, often influencing rapid price fluctuations.

Related Reading

Dogecoin is holding strong above the critical $0.10 level, a key psychological support for the asset. If the price maintains momentum, the next bullish target is around $0.11, which could spark more excitement and buying interest in the market.

As speculation continues, all eyes are on whether Dogecoin can sustain its recent strength or if it will face another wave of selling pressure. The coming days determine the meme coin’s direction in the weeks ahead.

Dogecoin Price Driven By Speculation

Dogecoin faces intense speculation as investors and analysts express differing views about its future price action. After several weeks of ups and downs, the meme coin has been subjected to massive volatility, reflecting the overall market’s erratic behavior. The uncertainty surrounding Dogecoin has led to heated debates about whether it will rally or continue to fall.

Key data from IntoTheBlock reveals the pivotal role of short-term traders in driving meme coins, particularly Dogecoin. These tokens thrive on hype and speculative trading activity, and DOGE leads the pack with the highest number of active short-term traders.

Over the past week, Dogecoin has seen approximately 113,000 short-term traders, underscoring its dominant position in the meme coin space.

Interestingly, DEGEN, a much smaller token, has also attracted around 23,000 short-term traders—similar to Shiba Inu’s, despite DEGEN’s market cap being only 10% of Shiba Inu’s size. This highlights the speculative frenzy within the meme coin ecosystem, where even lesser-known assets garner significant trading activity. Most mid-sized meme coins, in comparison, show only around 4,000 active short-term traders, illustrating Dogecoin’s continued strength.

Related Reading

Despite the speculative nature of these assets, Dogecoin’s ability to attract the most active traders signifies resilience and hints at a potential for future rallies, even amid broader market uncertainty.

DOGE Holding Above $0.10

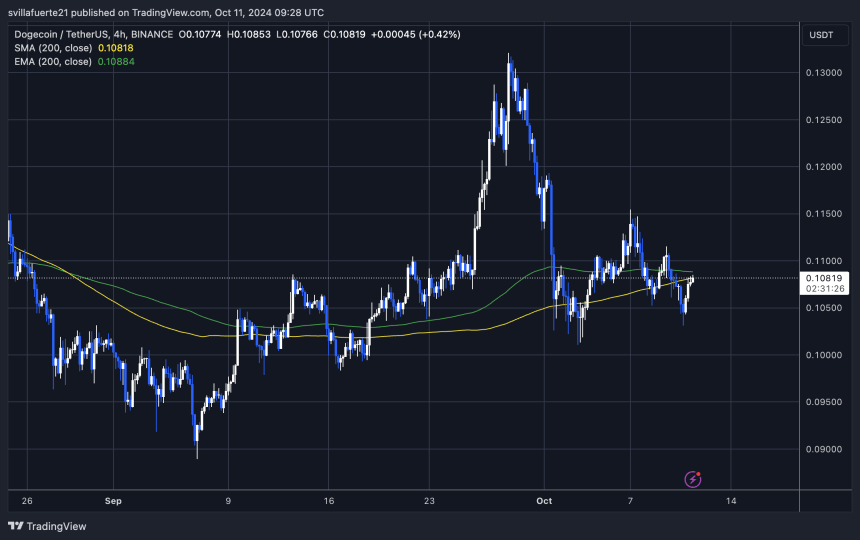

Dogecoin (DOGE) trades at $0.108, testing the 4-hour 200 moving average (MA) as resistance. Bulls aiming to maintain momentum must reclaim this key indicator to increase prices. The 4-hour 200 exponential moving average (EMA) also sits at $0.1088, just under 1% above the current price. This creates a crucial resistance zone for DOGE.

A clear break above the 200 MA and 200 EMA and the psychological $0.11 mark would likely trigger a rally, pushing the price higher as bullish momentum takes hold. However, failure to reclaim these indicators could lead to a more significant correction. In this case, DOGE could face a drop to $0.088, a key lower demand level, signaling further downside in the coming days.

Related Reading

As Dogecoin continues to test these levels, traders are closely watching for a decisive move that could indicate the next major trend, with the potential for a rally or further decline hinging on whether bulls can reclaim these moving averages and push beyond $0.11.

Featured image from Dall-E, chart from TradingView